March 30th, 2010 by

March 30th, 2010 by  Joern Meissner

Joern Meissner

The iPad, Apple’s newest technological wonder, will be released on April 3rd, just a few short weeks from now, but one thing probably missing from its advertised digital bookstore, iBookstore, will be the books from the world’s sales leader in publishing, Random House.

In the Financial Times article ‘Random House fears iPad price war’, Random House chief executive Markus Dohle said that Random House was still reviewing their options, as they fear that Apple’s pricing policy is of an interest to their stakeholders. The publisher was still in discussions with their agents and authors over the decision.

Random House is a division of Bertelsmann, whose profits declined over the past year, thanks in large part to the recession. And while the company believes they will make gains this year, they are not sure that allowing Apple to control the pricing policy of their e-books is the way to go about it.

Apple’s current e-book policy is that publishers will set the price for their own books, with Apple receiving 30 cents off every dollar. While the other five major publishers (which account for nearly all of Random House’s competition) have already signed on with Apple and their iBookstore, this new pricing scheme is very different from standard publishing policies.

In standard publishing pricing, the publishers sell books to the bookstores at a wholesale rate. The bookstores then make a profit by marking up the books from the wholesale rate. Bookstores can even return unsold books. Even Amazon, one of the world’s top bestsellers and one of the darlings of e-commerce, sells its book this way. While the publishers and Apple both agree that e-books are here to stay, neither is quite sure how to actually price them successfully to make both companies and their customers happy.

In the end, Random House must realize that a price war of any type is not beneficial to their company. If Random House takes Apple’s offer of controlling their own prices, they must quickly realize that trying to price their bestsellers at a price lower than their competitors will only result in spend-thrifty customers and low revenues. And if Random House decides to take Apple’s deal and then prices their books far too low, customers will always expect that price. And they will now be simply a few touches on the touchscreen away from picking up a book from Harper-Collins or Macmillan instead.

![[Slashdot]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/slashdot.png)

![[Digg]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/digg.png)

![[Reddit]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/reddit.png)

![[del.icio.us]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/delicious.png)

![[Facebook]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/facebook.png)

![[Technorati]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/technorati.png)

![[Google]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/google.png)

![[StumbleUpon]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/stumbleupon.png)

Posted in Pricing

Tags: Apple, Apple iBookstore, Apple iPad, Customer Retention, Digital Books, Digital Pricing, E-Book Pulishing, E-book Readers, E-Books, Financial Times, Harper-Collins, iBookstore, iPad, Macmillan, Markus Dohle, Price Point, Price War, Pricing, Pricing Strategy, Publishing, Random House

March 17th, 2010 by

March 17th, 2010 by  Joern Meissner

Joern Meissner

Customers have a habit of demanding lower prices, especially when they believe a product’s price represents a huge profit for the company. The case in point here is e-books, just one of many digital products facing the e-pricing dilemma.

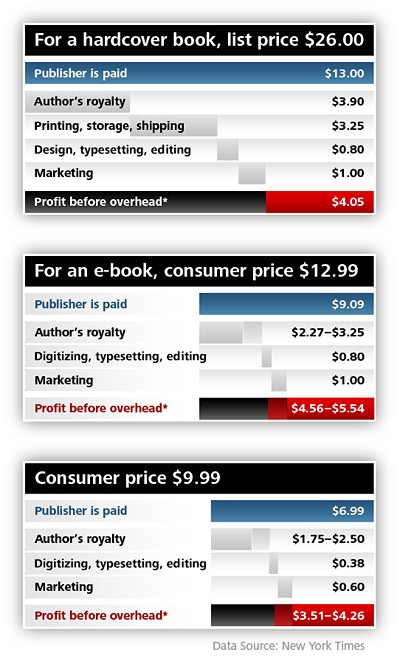

In recent weeks, thanks to the soon-to-be-released Apple iPad, five of the six major publishers banded together to demand a change in price. Up until now, Amazon, the leading e-book seller, has set most bestsellers at a $9.99 price point, but by making a deal with Apple to price books from $12.99 to $14.99 and threatening to remove their products from Amazon’s online store and it’s e-reader Kindle, the publishers were able to push up the price.

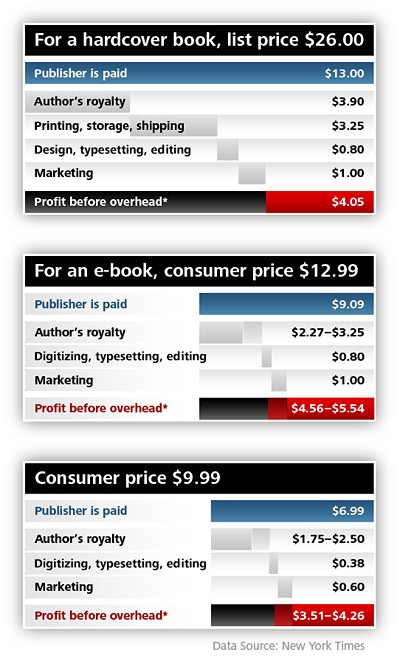

To illustrate why publishers keep pushing for the higher price, the recent New York Times article ‘Math of Publishing Meets the E-Book’ by Motoko Rich broke down standard hardcover book pricing and compared it to the new iPad digital pricing, also suggesting, according to Rich, that “customers have exaggerated the savings and have developed unrealistic expectations of how low the prices of e-books can go.”

A hardcover books costs about $26. After all the production, editing, marketing, and author’s royalties are paid (see graph), the publisher actually only sees about $4.05 in return, but that’s before any of the overhead bills are paid. Compare this to $12.99 digital price. In the new set-up with Apple, the publishers make between $4.56 to $5.54 in profit (see graph).

But this profit does not actually represent how much profit a publisher makes off any book. Like movie producers, publishers expect a loss on most of their products. Most books are published and disappear from the bookstore shelves long before the publisher recoups the author’s original advance and the original run’s printing costs. In the end, publishers truly only make money off major blockbuster books, further creeping into the publisher’s profitability.

On the other side of the pricing debate is the booksellers themselves. America only has two major booksellers left: Barnes N Noble and Borders, and many of the smaller independent have started shutting down due to Amazon. If the digital revolution takes hold with book-buying customers at too low a price point, it could also mean the end for traditional printed books, as there won’t be any bookstores left o sell them. Borders has already closed the majority of their stores in the U.K.

Some are advocating that the publishing world should step away from digital publishing and should discourage their customers from buying e-books by setting a high price for them. A similar idea has been put forth to save newspapers, which seems to be failing.

Many, however, realize that trying to hold back the digital revolution simply won’t work. Anne Rice, one of the most popular paranormal and horror writers in the world, said, “The only thing I know is a mistake is people trying to hold back e-books or Kindle and trying to head off the revolution by building a dam. It’s not going to work.” Publishers, a notoriously conservative business as a whole, are going to have to find a way to start looking towards the future, if they want to make their products viable and profitable once more.

![[Slashdot]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/slashdot.png)

![[Digg]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/digg.png)

![[Reddit]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/reddit.png)

![[del.icio.us]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/delicious.png)

![[Facebook]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/facebook.png)

![[Technorati]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/technorati.png)

![[Google]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/google.png)

![[StumbleUpon]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/stumbleupon.png)

Posted in Pricing

Tags: Amazon, Apple, Apple iPad, Barnes and Noble, Books, Borders, Demand, E-Book Pricing, E-Book Publishing, E-Books, E-Publishing, E-Readers, Elasticity, iPad, iTunes, Kindle, Macmillan, Motoko Rich, New York Times, NYT, Paying for Content, Price, Pricing, Publishing, Sony, United States, USA

February 24th, 2010 by

February 24th, 2010 by  Joern Meissner

Joern Meissner

While it’s common knowledge that the music industry was forever altered when iTunes, with its over 125 million customers, came onto the scene and allowed music fans to download songs for only 99 cents. In the past few years, it was the publishing world that has been changed, with digital book eaders like the Kindle and Nook, and online newspaper programs, like the recently mentioned Times Reader. Now it appears, it’s TV’s turn.

According to the article ‘Networks Wary of Apple’s Push to Cut Show Prices’ by Brian Stelter (New York Times, February 16th, 2010), Apple executives are in talks with the heads of all the major television networks to plan a widespread price decrease for downloading TV episodes from iTunes.

Each TV show episode, with the exception of a few promotions from PBS, currently sells for a $1.99 per download. But for Apple, the magic number has always been 99 cents. It was the 99-cent price point that allowed iTunes to nearly overnight become the world’s main, and in most peoples’ eyes the only, place to buy music. iTunes’s 99 cent price point could very easily be said to be responsible for the end of the CD and probably helped lead to the end of nationwide electronic store Circuit City.

Apple executives are said to believe that by lowering TV episodes, released on iTunes only the day after their original broadcast on television, to the 99 cent price point could allow the mainstreaming of TV episode downloading, just as it did for music. With several new, cheaper models of digital and portal TV quickly becoming available, like Apple’s upcoming iPad, Apple believes this is its next goldmine waiting to be harvested.

TV executives on the other hand are not so sure. TV shows can cost millions of dollars to produce, and it normally takes hundreds of people (all of whom need to be paid) to produce a single episode. Unlike songs, which are often created in studios by a handful of professionals, TV shows will need far higher sales to return profitable returns.

On the other hand, if lowering the price point does help buying TV episodes become part of the mainstream world culture, as buying songs from iTunes has, then it might be worth it. Consumers have purchased over 10 billion songs from iTunes, while they have only purchased 375 million TV episodes, a huge difference in profits. And considering that there will also always be fewer episodes available then songs, this difference could translate into the change being well worth the risk for TV executives.

As with most digital products, there is little additional cost, so this situation is not about profit maximization, but simply revenue optimization. The refusal of the TV executives to lower the price indicates that they believe the market is not elastic, e.g. they do not believe there would be a volume gain sufficient enough to compensate for the lower price. In this particular case the calculation is easy, as a price decrease from $1.99 to $0.99 must result in doubling the volume to make sense. Apple, on the other hand, would probably be satisfied if it breaks even, as long as this fuels hardware sales.

A $0.99 price point could lead to a large demand raise, probably even of 100 percent. On the other hand, it could be that TV content is already bought by users that are less likely to download files from a peer-to-peer file sharing network, and demand is not actually elastic, which would be required if the demand was to raise high enough. In any case, it will be interesting to see what is going to happen.

![[Slashdot]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/slashdot.png)

![[Digg]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/digg.png)

![[Reddit]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/reddit.png)

![[del.icio.us]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/delicious.png)

![[Facebook]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/facebook.png)

![[Technorati]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/technorati.png)

![[Google]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/google.png)

![[StumbleUpon]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/stumbleupon.png)

Posted in Pricing

Tags: Amazon Kindle, Apple, Apple iPad, Apple iTunes, Brian Stelter, Circuit City, Demand, Digital Pricing, E-Commerce, E-Products, Elasticity, iPad, iTunes, Kindle, Music, Nook, Paying for Content, Price Point, Pricing, Revenue Optimization, Television, Times Reader, TV Episodes, TV Series

February 19th, 2010 by

February 19th, 2010 by  Joern Meissner

Joern Meissner

The New York Times may be the world’s most recognized newspaper, but even they cannot withstand the changing times forced upon the journalism sector by the internet. With free news available to all online, newspapers are trying to find a way to remain both relevant and profitable.

According to the report ‘Turf War at the New York Times: Who Will Control the iPad?’ at Gawker.com, a New York City-based media rumor and news website, The New York Times has just entered into a battle against itself over the not-yet-released iPad. The central tenant of this argument is the pricing for the new Times app for the iPad. The print circulation team wants the price to be $20 to $30 per month per customer, while the digital side wants both control over the app and the pricing to be placed at $10.

To break down the argument on both sides, the print circulation team represents old school journalism and the control of the Times print edition – the edition that is quickly becoming unprofitable. They want to use the higher pricing on the app to leverage the costs of the print edition and to keep it running as it always has. This would also mean a portion of the control over the app’s finances and features would be in the hands of the print circulation team.

Their opposition, the team in charge of the Times’ current digital content, is saying that the price is far too high when compared to other online newspapers, especially considering two major factors. The first is that several other major newspapers have agreed to hold off on forcing online customers to pay subscription fees until 2011. The iPad will be out much sooner than this. The second is that current Times subscribers to the Times Reader (which can be downloaded onto any computer, unlike the iPad version, which will be exclusively for the iPad) currently only pay $15. The digital team doesn’t want that much of a difference between pricing.

Unfortunately for the digital content team, it appears to Gawker that New York Times Media Group President Scott Heekin-Canedy is currently siding with the print circulation team. In another report by Gawker titled ‘The New York Times’s iPad Fight Was Part of a Longer Civil War,’ the answer is given that this is all to try to protect the failing print edition at any costs.

Essentially, this battle is not new for the Times. When the Times Reader was introduced, insiders reported that the digital team wanted a price of $6. Instead, the price was kept significantly higher to stop customers from ending their subscriptions to the print edition of the paper.

In a journalism world where magazines and newspapers are shutting down every day, why would the industry leader back away from new technologies and try to impose yesteryear’s pricing on today’s digital models? Customers in today’s market can easily realize that the production costs to create a web or app version of The New York Times is far below the production cost of the printed model. The customers aren’t going to pay for what they see as too high a price.

Essentially, if the Times goes with a $30 iPad subscription fee, why would anyone bother to pay for it when they can get the real thing for just a little more? The move could be self-sabotaging or it could prove that customers are willing to pay for the convenience and quality of the New York Times when so many other free sources for news are available. In short, only time will tell which route the Times will take and which one it should have taken.

![[Slashdot]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/slashdot.png)

![[Digg]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/digg.png)

![[Reddit]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/reddit.png)

![[del.icio.us]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/delicious.png)

![[Facebook]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/facebook.png)

![[Technorati]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/technorati.png)

![[Google]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/google.png)

![[StumbleUpon]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/stumbleupon.png)

Posted in Pricing

Tags: Apple iPad, Content, Digital, Digital Pricing, iPad, Media, New York Times, Online, Paying for Content, Pricing, Scott Heekin-Canedy, Subscription Fee, Web

January 21st, 2010 by

January 21st, 2010 by  Joern Meissner

Joern Meissner

The New York Times announced this week that they would again charge customers for online services. In this new system, non-subscribers (subscribers to the newspaper will have full access to online content) can read a handful full of free articles a month, but after using their allotment, will be forced to pay for an unlimited online subscription. Or, at least, wait until the next month.

This move comes as a form of déjà vu, as this is similar to a failed plan for The New York Times from 1996 that attracted only 4,000 subscribers. After several attempts at paid online services, the Times went free, hoping to attract enough advertisers to cover costs, but because of the recession, they’ve spent the last year developing new plans. The company released a statement containing the reasoning that this will enable NYTimes.com to create a second revenue stream and preserve its robust advertising business. Janet L. Robinson, CEO of The New York Times Company, added (The Times to Charge for Frequent Access to Its Web Site, New York Times, January 20th, 2010):

We were also guided by the fact that our news and information are being featured in an increasingly broad range of end-user devices and services, and our pricing plans and policies must reflect this vision.

With the creation and mainstreaming of portable devices, like the Apple iPhone and the imminent iPad, that can read the Times anywhere and can fit in your pocket, the Times, and all newspapers like it, must evolve. This leaves the question of while the company will spend 2010 building an infrastructure for this program, can they ever hope to keep up with the changing ways newspapers are read and still manage to charge people. Arthur Sulzberger Jr., the company chairman and publisher, responded:

This is a bet, to a certain degree, on where we think the Web is going. This is not going to be something that is going to change the financial dynamics overnight.

The New York Times is taking what might be viewed as a risky move in the already embattled journalism field. However, the time of the announcement is to be lauded. With the announcement of the Apple iPad next week, this is the best timing to make users view content in a different way. This often is the key to a price increase, introducing a different version or modification of the product. Customers will, more often than not, walk away from raised prices, especially in the case of the Times, since the product used to be free. By allocating their content into something that the customer can see as having actual benefit (like being able to access it anywhere), then the Times may have a chance to attract customers while they were unable to do so before (when portable devices didn’t exist). So, while the timing is perfect, it remains to be seen whether the action pays off big or the free-for-all online culture will prevail.

![[Slashdot]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/slashdot.png)

![[Digg]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/digg.png)

![[Reddit]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/reddit.png)

![[del.icio.us]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/delicious.png)

![[Facebook]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/facebook.png)

![[Technorati]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/technorati.png)

![[Google]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/google.png)

![[StumbleUpon]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/stumbleupon.png)

Posted in Pricing

Tags: Apple iPad, Apple iPhone, Arthur Sulzberger Jr., Free Content, Internet, iPad, iPhone, Janet L. Robinson, New York Times, Online, Paying for Content, Web

![]() March 30th, 2010 by

March 30th, 2010 by  Joern Meissner

Joern Meissner